As we enter 2021, it is always a good idea to take note of changes to the tax code as well as some items that remained unchanged. This will allow you to plan appropriately for the upcoming year.

Here are the adjustments made for 2021:

The Standard Deduction was increased to $12,550 for single filers and those who are married but file separately. Head of households had their Standard Deduction increased to $18,800. Married couples who file jointly saw their deduction increase to $25,100.

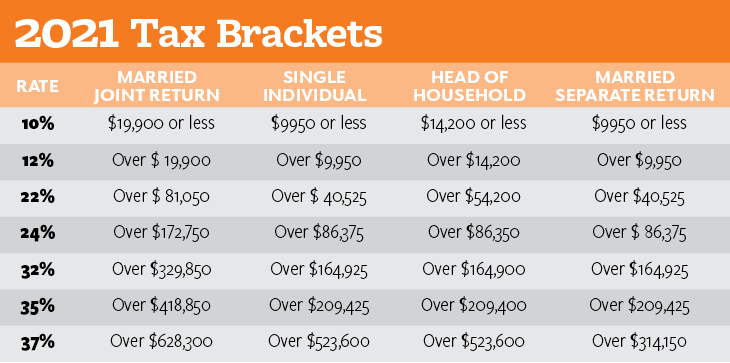

There was not a change to the income tax rates, but the brackets were increased slightly.

The capital gains rates also remained unchanged, but the income bracket that determines those rates increased. Those who file as married filing jointly and earn $80,800 or less will pay a 0% capital gains rate. Single filers and married filing separately earning $40,400 per year or less will pay a 0% capital gains rate and head of households earning $54,100 or less will also pay a 0% taxable gains rate. Adjusted net capital gains up to $501,600 for joint returns; $250,800 for married individuals’ separate returns; $473,750 for head of household returns; and $445,850 for single individual returns will pay a 15% capital gains rate. The capital gains rate for earnings above these amounts is set at 20%.

The maximum contribution amount an individual can put into an employer provided retirement plan remained unchanged. Individuals will still be able to contribute $19,500 and the catch-up contribution for those age 50 and older remains at $6,500. For SIMPLE retirement accounts the contribution limit remains $13,500 with a $3,000 catch up.

No changes were made to the maximum annual contribution amount someone can contribute to an Individual Retirement Account (IRA). The limit remains at $6,000 for both pretax or Roth IRAs and the catch-up for those 50 and older is unchanged at $1,000. The modified gross income (AGI) phaseout for being able to deduct contributions to a to a traditional IRA for single and heads of household who are covered by a workplace retirement plan is between $66,000 and $76,000. The income phase-out range for married couples filing jointly, in which the spouse who makes the IRA contribution is covered by a workplace retirement plan, is $105,000 to $125,000. The income phaseout for an IRA contributor not covered by a workplace retirement plan and who is married to someone who is covered, is between $198,000 and $208,000 in 2021.

The Roth IRA AGI phase-out range for singles and heads of household increased to between $125,000 and $140,000. For married couples filing jointly the phase out range increased to between $198,000 and $208,000. You can still contribute to a Roth IRA if your income exceeds these amounts, but you will need to open a nondeductible IRA and convert each contribution and move it into a Roth IRA. This is commonly referred to as a backdoor IRA.

There were additional changes to the Alternative Minimum Tax (AMT), individual tax credit, and allowances for fringe benefits, MSAs, and estates.

As a reminder, the special tax provisions enacted as part of the CARES Act, which was passed to provide relief during the COVID-19 pandemic, expired at the end of 2020. The old rules regarding distributions, loans, and RMDs are now back in effect unless extended by new legislation.

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink)

Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow)

Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)

The maximum contribution amount an individual can put into an employer provided retirement plan remained unchanged. Individuals will still be able to contribute $19,500 and the catch-up contribution for those age 50 and older remains at $6,500. For SIMPLE retirement accounts the contribution limit remains $13,500 with a $3,000 catch up.

No changes were made to the maximum annual contribution amount someone can contribute to an Individual Retirement Account (IRA). The limit remains at $6,000 for both pretax or Roth IRAs and the catch-up for those 50 and older is unchanged at $1,000. The modified gross income (AGI) phaseout for being able to deduct contributions to a to a traditional IRA for single and heads of household who are covered by a workplace retirement plan is between $66,000 and $76,000. The income phase-out range for married couples filing jointly, in which the spouse who makes the IRA contribution is covered by a workplace retirement plan, is $105,000 to $125,000. The income phaseout for an IRA contributor not covered by a workplace retirement plan and who is married to someone who is covered, is between $198,000 and $208,000 in 2021.

The Roth IRA AGI phase-out range for singles and heads of household increased to between $125,000 and $140,000. For married couples filing jointly the phase out range increased to between $198,000 and $208,000. You can still contribute to a Roth IRA if your income exceeds these amounts, but you will need to open a nondeductible IRA and convert each contribution and move it into a Roth IRA. This is commonly referred to as a backdoor IRA.

There were additional changes to the Alternative Minimum Tax (AMT), individual tax credit, and allowances for fringe benefits, MSAs, and estates.

As a reminder, the special tax provisions enacted as part of the CARES Act, which was passed to provide relief during the COVID-19 pandemic, expired at the end of 2020. The old rules regarding distributions, loans, and RMDs are now back in effect unless extended by new legislation.

15% Off Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)__________________________________________________

Appointment Reminder Cards

$44.05

15% Off

$56.30

15% Off

$44.05

15% Off

$44.05

15% Off

$56.30

15% Off