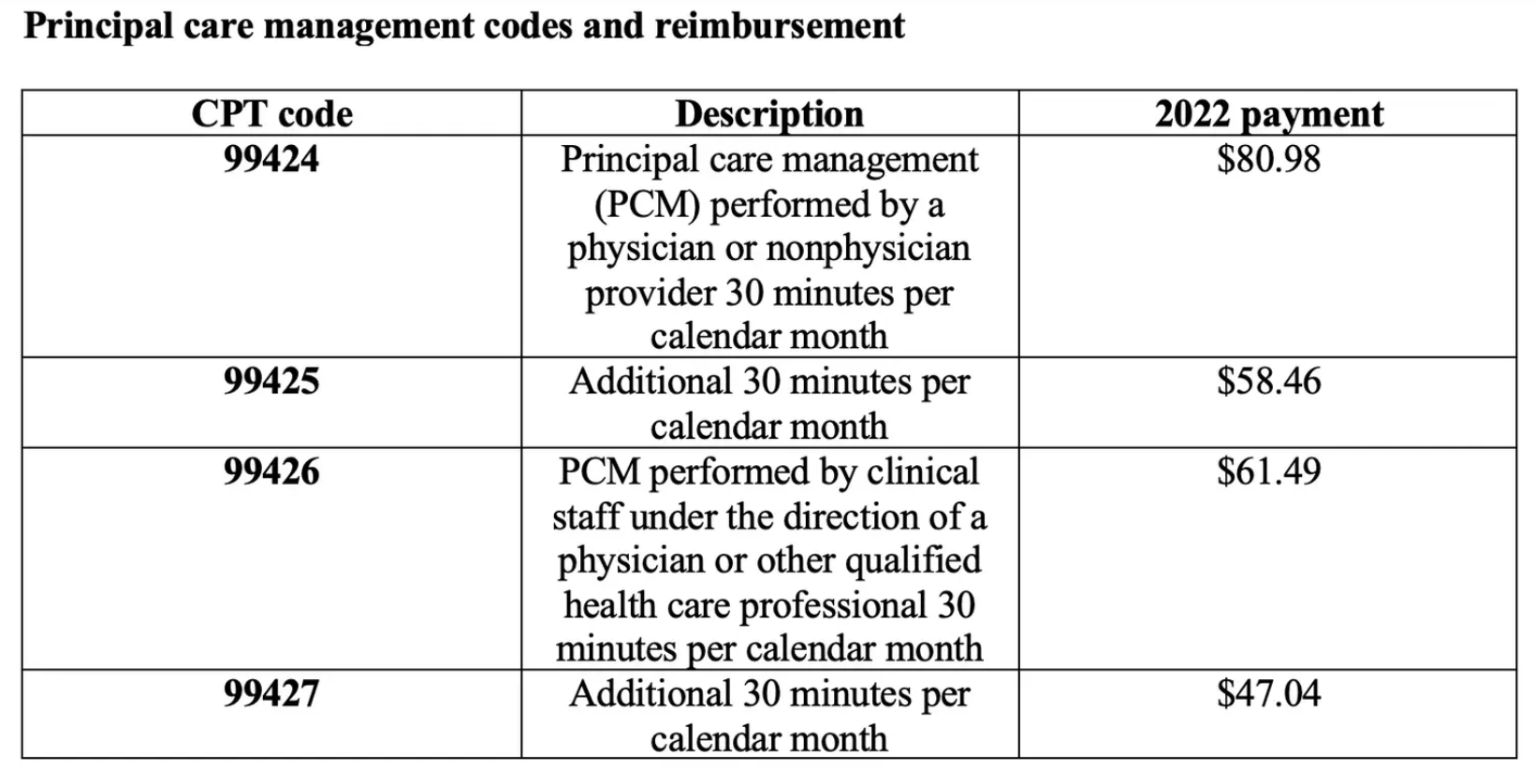

Effective in 2022, Medicare began accepting four new current procedural terminology (CPT) codes for principal care management (PCM) and discontinued two Healthcare Common Procedure Coding System G codes. Experts say the new codes, which are paid at a higher rate than the G codes, afford physicians the opportunity to improve outcomes while simultaneously generating additional revenue.

What are the codes?

What is PCM?

PCM is similar to chronic care management (CCM) in that both services are for patients who require ongoing clinical monitoring and care coordination. However, unlike its CCM counterpart, PCM only requires patients to have one complex chronic condition; CCM requires three or more.

For example, PCM could be appropriate for a patient with uncontrolled diabetes or uncontrolled hypertension or a high-risk patient with severe asthma who has frequent hospital readmissions, says Terry Fletcher, B.S., CPC, , a health care coding and reimbursement consultant. It could also be necessary for someone with hepatitis C, fibromyalgia, long-haul COVID-19 or a variety of other complex chronic conditions, she adds.

“Many practices are already doing this work to take care of these patients,” says Lori Foley, CHC, CMA, principal of compliance advisory services at PYC, P.C., a professional services firm specializing in health care consulting and certified public accounting. “They just need to capture the right information so they can bill for it compliantly.” That information includes details such as disease-specific care plans, adjustments in medication regimens, ongoing communication with specialists and more.

Physicians who treat a high volume of Medicare patients should definitely consider providing and billing for all care management services, including transitional care management (TCM), CCM and PCM because this population tends to struggle with at least one chronic condition and frequent hospitalizations, says Don McDaniel, CEO of Canton & Company, a health care growth and strategic services firm.

Consider a patient who is admitted to the hospital with uncontrolled hypertension. The patient may require TCM for 30 days after discharge, followed by PCM for an additional 30 days or more. If the patient develops an additional complex chronic condition that requires ongoing monitoring, they may even be eligible for CCM instead of PCM. Note that CCM is also a 30-day service for a patient with two or more chronic conditions expected to last at least 12 months that place the patient at significant risk of death, acute exacerbation/decompensation or functional decline.

“PCM is one tool in a toolbox of different options (that) practices can piece together to support building the right kind of infrastructure and surveillance needed to support patients,” says McDaniel.

How can physicians provide PCM effectively?

Experts provide these five considerations for physicians who plan to offer PCM in the months ahead:

1. Choose the right patients.

Not every patient with a complex chronic condition requires PCM. “Make sure you’re documenting that the condition is severe enough that the patient is at risk for hospitalization or was recently hospitalized several times due to that condition,” says Fletcher.

Fletcher audits CCM claims on behalf of various insurance companies and says the biggest reason for recoupment is that diagnoses for which CCM is performed don’t meet billing criteria or Medicare program integrity rules; she suspects the same may be true for PCM. For example, physicians can’t bill PCM for patients with a well-controlled chronic condition, she says.

2. Bill the right codes.

Report CPT codes 99424 and 99425 when a physician or nonphysician provider performs the PCM, and report CPT codes 99426 and 99427 when clinical staff under the direct supervision of a physician or other qualified health care professional provide the service.

Fletcher says examples of clinical staff might include an RN, clinical psychologist or medical assistant. However, she cautions physicians to check with payers and state nursing boards before billing because every state is different.

3. Document patient consent.

And be sure to document that you’ve notified the patient that their coinsurance applies, says Foley.

4. Document who did what and for how long.

“We promote a log that’s very clear: name, time spent, what they did specifically and their credentials,” says Foley. “The good news is that EHRs (electronic health records) have come a long way since 2016 when CCM rolled out, and many have integrated tools for time aggregation that facilitates the billing process.”

McDaniel agrees, adding that physicians intending to bill PCM should ask their EHR vendor whether it supports a care management workflow.

5. Determine whether you’ll outsource PCM.

McDaniel says to ask these questions: What type of PCM services are you currently providing but not billing? Are you able to bill for those services and potentially cover the cost of hiring an additional staff member who might also be able to provide other types of care management services such as CCM and TCM?

“Do the research and find out if you can afford to hire someone,” says McDaniel. “If you find out you can’t do it, you still have the ability to hire a third party to support the activity.”

Principal care management billing criteria

To bill for principal care management (PCM), patients must have one complex chronic condition that meets the following six criteria:Is expected to last at least three months.

- Puts the patient at significant risk of hospitalization, acute exacerbation/decompensation, functional decline or death.

- Requires development, monitoring or revision of a disease-specific care plan.

- Requires frequent adjustments in medication regimens, and/or the management of the condition is unusually complex due to comorbidities.

- Requires ongoing communication and care coordination between relevant practitioners furnishing care.

- Requires at least 30 minutes of PCM services per calendar month.

15% Off Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)__________________________________________________

Appointment Reminder Cards

$44.05

15% Off

$56.30

15% Off

$44.05

15% Off

$44.05

15% Off

$56.30

15% Off