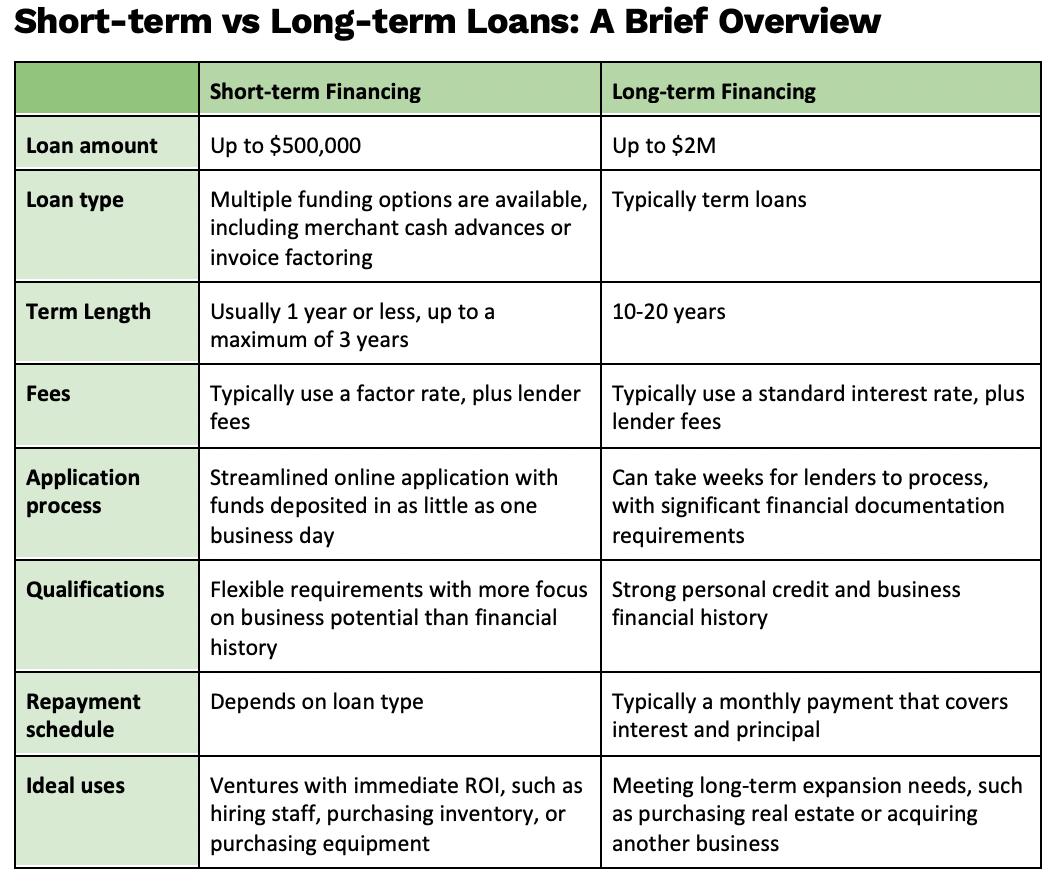

One of the easiest ways to narrow down your options is to determine whether you need short- or long-term financing. In this post, we will explore short term vs. long-term loans for medical practices to help you determine which option is best for your specific situation.

Let’s take a closer look:

When is short-term or long-term financing ideal?

Short-term medical business loans are usually issued for smaller amounts and can typically be acquired more quickly and with less stringent documentation than long-term loans. Short-term small business funding is best used to finance opportunities that have a more immediate return on investment, such as hiring a new staff member or upgrading your practice management software. Short-term financing can also provide a quick infusion of working capital that can help you bridge the gap between insurance payments, invest in marketing your medical practice, or kickstart your growth.

Long-term medical business loans are typically offered for higher amounts and lower rates, making them ideal for large purchases or investments. The approval process takes longer and the requirements are stricter, so you’ll need to be able to demonstrate why you need the money, that it will be put to good use, and how you plan to pay it back. For this reason, long-term small business loans are best used for investing in longer-term ventures that may not have an immediate return on investment, but are necessary for growth, such as purchasing your officespace rather than renting it.

How medical practices can use short- and long-term funding

Medical practices can use both short- and long-term funding for different purposes. Each type of funding is suited to specific purchases or investments, so make sure you select the type of funding that is best suited to the purchase you want to make.

Short-term business loans

Short-term business loans are ideal for smaller expenses that you can act on and pay off quickly, such as:

- Start up costs

- Bridging cash flow gaps

- Purchasing inventory or medical supplies in bulk for a discount

- Covering costs of emergency repairs or other unexpected expenses

- Hiring new employees

- Purchasing equipment, tech, software

- General working capital

- Boosting your marketing

- Improving patient services, such as upgrading your services to include online booking, online paperwork, updated wait times, quick responses to inquiries, free wifi in your waiting room, or extended hours

Long-term business loans

Long-term business loans are typically better suited to large expenses or purchases that you can pay down slowly, including:

- Purchasing real estate

- Acquiring another practice—this is a great way to expand your existing practice or avoid some of the pitfalls of starting your own from scratch.

- Building or renovating facilities

Which type of term loan is right for my medical practice?

The type of funding that’s right for you, whether short-term or long-term funding, depends on multiple factors, such as how quickly you need the money, how much funding you require, what you plan to use your funding for, as well as details important to the lenders, such as your financial history and the financial health of your medical practice.

15% Off Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)__________________________________________________

Appointment Reminder Cards

$44.05

15% Off

$56.30

15% Off

$44.05

15% Off

$44.05

15% Off

$56.30

15% Off

No comments:

Post a Comment