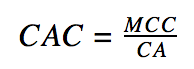

The cost of customer acquisition (CAC) means the price you pay to acquire a new customer. In its simplest form, it can be worked out by:

The cost of customer acquisition (CAC) means the price you pay to acquire a new customer. In its simplest form, it can be worked out by:

Dividing the total costs associated with acquisition by total new customers, within a specific time period.

Do not get this metric confused with cost per action (CPA), as there is a strong distinction between the two. In ecommerce, cost per action is typically the amount you pay to convert a customer - i.e to make a sale - but this relates to both new and returning customers.

CAC is all about acquiring new customers. See how even Google refers to CPA as ‘the cost you are willing to pay to make a conversion’ NOT to acquire a new customer.

The importance of CAC in ecommerce

Ok, so we know what it is but why is it important? You’ve got a lot to do - how is this going to make you more money?

I hear you!

The cost of customer acquisition is one of the MOST important metrics for any ecommerce store, along with the lifetime value of a customer. Why? Because your store needs to make money. Which means you need to get a return on investment (ROI) from your marketing and sales campaigns.

The important ratio to focus on, then, is one that tells you exactly how much value you're making from your customers in relation to how much it cost me to acquire them:

LTV:CAC

It's as simple as this: your business will fail if your CoCA is higher than your LTV. Let’s go through a few scenarios to assess what you should be aiming for with regards to the LTV:CAC ratio.

- Less than 1:1- You’re on the road to oblivion, and fast

- 1:1 - You’re losing money from every acquisition

- 3:1 - The perfect level. You have a thriving business and a solid business model.

- 4:1 - Great news but you’re under investing and could be growing faster. Start more aggressive campaigns to acquire customers and bring your ratio closer to 3:1

As well as the above you need CAC to assess how your marketing campaigns are performing. The goal is to find the marketing channels that have both a high LTV:CAC ratio and are scalable. There is no use only focusing all your time on channels that send only a very small amount of customers. Find the right balance between time/effort, LTV:CAC and quantity of customers acquired.

To summarise, there are two key reasons that CAC is very important:

1) Working out your LTV:CAC ratio and the months required to recover your CAC helps you analyse the overall health of your business. Figuring out the months required to recover CoCA is very useful to determine how strong your business model is. It’s no good if it will take three years to recover your initial investment because you need to reinvest that money. A great target to aim for is anything under 12 months.

2) CAC helps you optimise your marketing campaigns and channels - Where are you acquiring your best customers from? What channels and campaigns have the best LTV:CAC ratio? Remember that customer acquisition cost for different campaigns are not constant. They change all the time and you must be vigilant of this - when you stop getting an ROI then stop the investment.

How to calculate CAC for your ecommerce store

There are two methods for working out cost of customer acquisition: a simple (but less accurate) way and a more complex way that involves many other variables.

Ultimately, there is only one way that is correct, which is the complex way. However, doing things the simple way is more useful than not doing them at all in order to get an idea of how different channels are performing in relation to each other. Be wary of using it when going over your LTV:CAC, as it misses out a lot of key costs.

The simple method for working out CAC

Where:

CAC = Cost of customer acquisition

MCC = Total marketing campaign costs related to acquisition (Not retention)

CA = Total customers acquired

In the above when I refer to marketing campaign costs, I’m talking about the direct costs associated with running a banner ad based on the quantity of impressions or the total cost per click of adwords campaigns.

15% Off All Business Cards

VIEW ALL CARDS

$60.05

$60.05

$62.55

$60.05

$60.05

$60.05

$60.05

$52.55

$60.05

$60.05

No comments:

Post a Comment