Whether you are a new doctor fresh out of medical school and ready to open your own practice or you’re an established and respected medical professional with many years under your belt and numerous patients in your roster, even the best businesses may need to borrow money at some point in order to keep things operating smoothly and continue growing.

Acquiring medical practice loans can be challenging, but if you don’t need to borrow a huge sum, lines of credit are a flexible, less-strict borrowing option that maysuit your needs better than a long- or short-term loan.

In this post, we will take a look at:What a line of credit is and how it works

What the pros and cons of a line of credit are

How doctors’ offices can use lines of credit

Let’s jump in.

What is a line of credit and how does it work?

A line of credit is a flexible form of credit offered by both traditional banks and alternative lenders. There are two types of credit lines:Secured: With a secured line of credit, you will be required to pledge assets (e.g., real estate, equipment, or inventory) as collateral.

Unsecured: With an unsecured line of credit, you are not required to provide collateral, but the requirements for your credit score and business history will be higher.

Once you have been approved for a line of credit by a lender, you can draw and repay from the line whenever you need and will only pay interest on what you have borrowed—similar to how a credit card works. As long as your business is performing as well or better than it was when the line of credit was approved and the term is unfixed, you can borrow from the line repeatedly even if you haven’t paid it back in full yet.

In general, a credit line has longer terms and lower rates than credit cards, as well as fewer obligations than a fixed term loan, making them ideal for covering things such as unexpected expenses, renovations, or equipment. However, it is important to note that the type of lender you borrow from can impact interest rates and borrowing amounts—alternative lenders have less stringent approval requirements, making it easier to get approved, but they also typically have lower funding amounts and higher rates than a traditional bank as a result

Pros and cons of a line of credit

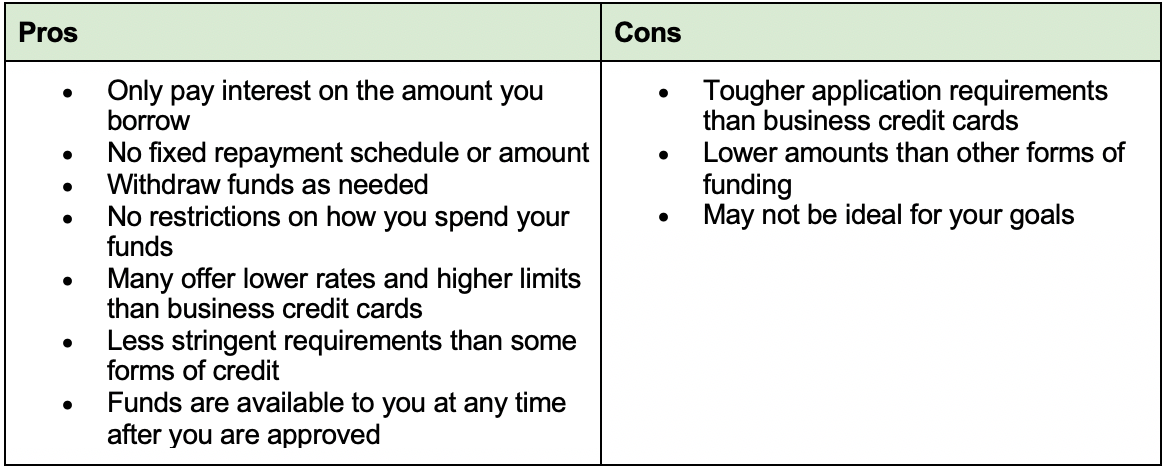

Like all forms of money borrowing, there are both pros and cons to opening a credit line. A line of credit is not inherently better or worse than other types of loans, but there are times when they make more or less sense for your specific situation. So, how do you know if a line of credit is right for you? Evaluate their pros and cons to help figure out if they’re a good fit for your unique situation:

How doctors’ offices can use a line of credit

While a line of credit does not offer the highest loan amounts, there are no limitations on what a line of credit can be used for. This makes it very easy to use for multiple types of undertakings, including (but not limited to):Purchasing new supplies

Opening additional practices or offices

Upgrading or replacing equipment, software, and technology

Bolstering your business’s marketing

Filling in cash flow gaps during slow seasons

Covering unexpected expenses

Funding growth strategies and other purchases with high up-front costs that have a strong ROI

Financing an expansion, merger, or acquisition

Conclusion

There are many types of medical practice loans, but a line of credit is one of the most flexible forms of renewable funding that can be used to purchase or assist in the purchase of many things that can benefit and grow your medical practice. Having a credit line set up, either through a traditional bank or an alternative lender, can help you down the road when unexpected expenses or opportunities crop up—you will always have access to that money when you need it, so long as you continue to pay it off.

15% Off Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)__________________________________________________

Appointment Reminder Cards

$44.05

15% Off

$56.30

15% Off

$44.05

15% Off

$44.05

15% Off

$56.30

15% Off

No comments:

Post a Comment