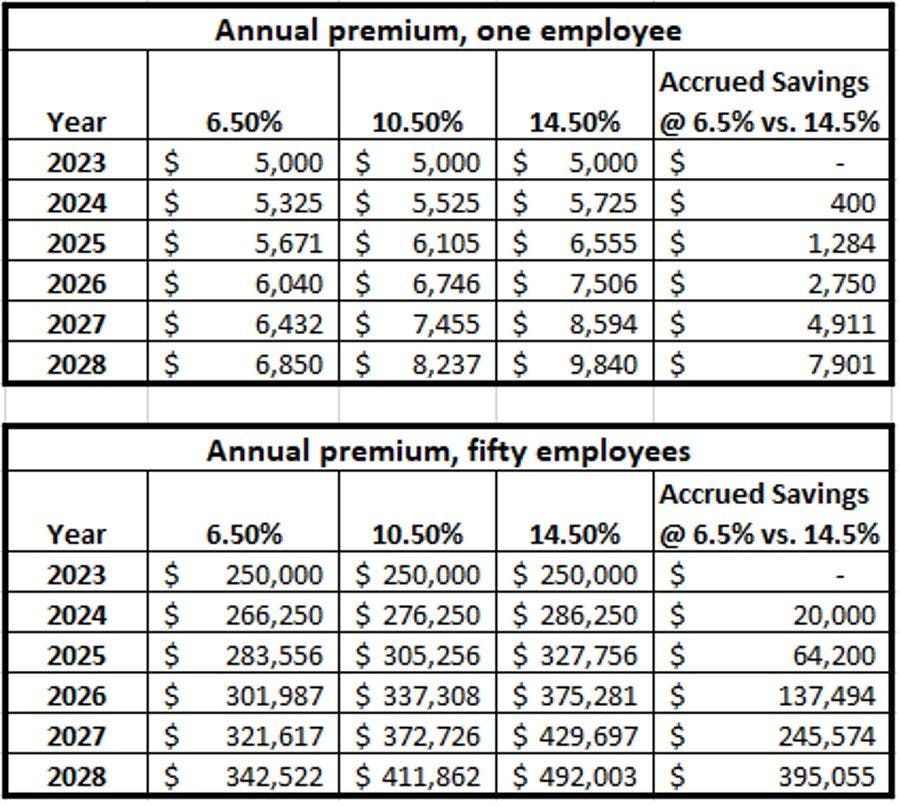

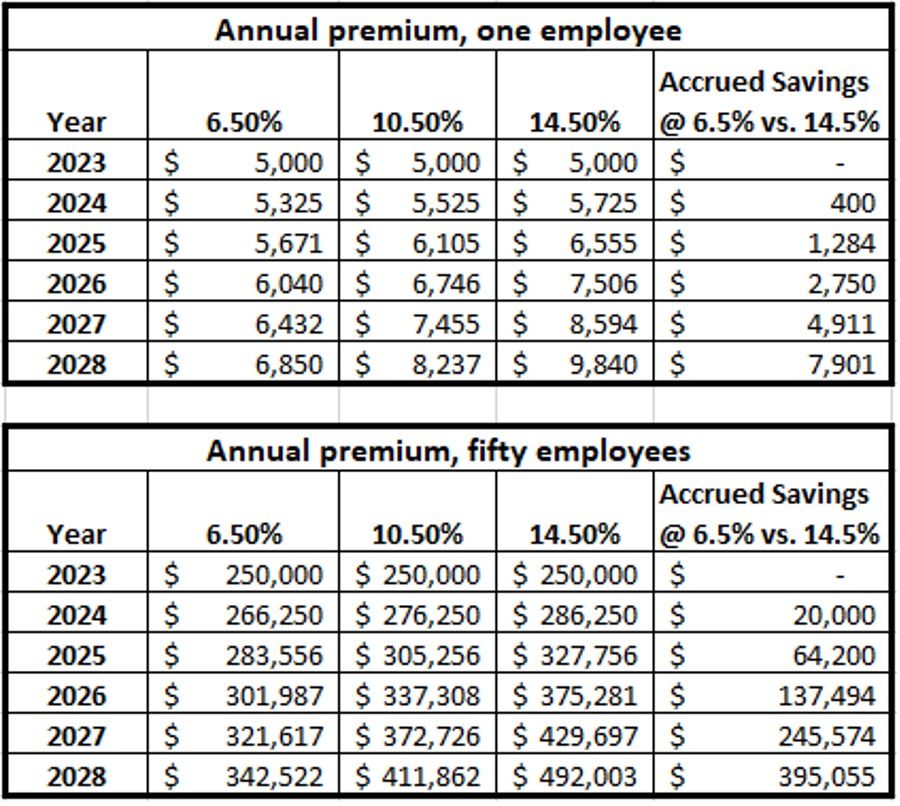

Your health insurance premiums increase annually. The following example shows how compounding works against you. At the end of five years, an employer with fifty employees who keeps their renewals at 6.5% rather than 14.5% saves $395,055 over five years. Compounding works for you in the stock market but against you in the health insurance market.

Courtesy of Lucien W. Roberts, III, MHA, FACMPE

Here is my basic premise: where your employees get their healthcare care impacts YOUR income. Where you get your healthcare impacts THEIR income. This truth is neither understood nor appreciated by many, so let's go there.

- Next year's health insurance renewals are driven by this year's health insurance claims. If the claims paid out by the insurance company are MORE than the premiums paid by your practice, the insurance company loses money. It raises premiums for next year to make up for this year's loss. The take-home message is that saving money on this year's health spend keeps next year's renewal premiums lower.

- Every paid claim goes into a bucket that is balanced against the premiums. While it may not seem to matter if you get your MRI at $$$$ facility or $$ facility, it does. And if 20 of your employees get their care for $$$$ rather than $$, everyone's premiums go up next year unnecessarily. Every dollar spent unwisely is a dollar not saved wisely. All of you – partners, APPs, employees - have skin in this game and a duty to each other to not waste 'our' premium dollars.

- Less expensive does NOT mean less good.My freestanding infusion center, Infusion Solutions, may be the least expensive option in town, yet I will put my Infusion Solutions team up against anyone, any day. We take great pride in giving better care for less.It saves patients money, and it saves their employers money via lower premium increases. Value shopping should be an integral part of where we spend our healthcare dollars if we want to keep premiums in check.

- Let’s dispel a myth about high deductibles. When YOU meet your annual deductible, it means that YOU aren't going to be paying any more out of pocket THIS YEAR. But every dollar spent above and beyond the deductible is going into the bucket that determines next year's premiums. You and your employees WILL pay more next year. It is still critical for you and your employees to price shop once the deductible has been met.

Some of the worst times during my career were when I knew the insurance renewal increase was going to be greater than the annual raises I was giving my folks. My employees' income would go down despite the raise. It was before I really grasped that I had the power to bend the curve by spending my healthcare dollars more wisely and by educating and encouraging my co-workers to do the same. I know better now.

You, as a leader, can bend this cost curve.Be open with your staff.Help them understand these dynamics – the practice’s fiscal health and their fiscal health are intertwined.Share your personal efforts to choose your healthcare wisely.Finally, repeat this message several times during the year. The last point is critical, as ongoing vigilance is needed to create good healthcare spending habits.

15% Off Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)__________________________________________________

Appointment Reminder Cards

$44.05

15% Off

$56.30

15% Off

$44.05

15% Off

$44.05

15% Off

$56.30

15% Off

No comments:

Post a Comment