Mergers and acquisitions (M&A) is an umbrella term that covers quite a lot. For this article though, I am narrowing it down to just mergers; that is, two or more practices “joining together” as compared to a practice being “bought out entirely”. If you are a physician practice owner who is considering a merger at some point, it is vital to learn more about this process early in the game. As I have written about in previous articles, while a merger can prove vital for your practice, the business will definitely go through some changes in order to stay relevant and profitable. Mergers are a principle way for some practices to expand. If you do so, however, there are certain traps you must avoid.

Finding a good fit

Trap: Failing to reach a meeting of the minds.

Each owner may have an initial idea of what he or she wants to accomplish with the merger, but together they may fail to flesh out the details to achieve their goals. For instance, one may be older and views the merger as an eventual exit strategy. That’s fine, but this can mean the older owner may have a conservative approach to the business and may not want to spend money on expansion. The younger owner may be more willing to take risks and may disagree on the direction of the practice in this situation. If both owners have failed to discuss their expectations candidly, they will probably become frustrated and unhappy after the deal has closed, which can undermine the success of the merged practices. Many physicians use consultants here early on to help facilitate these discussions and ensure the two practices are truly open about their desires and intentions.

Trap: The inability to mix company cultures.

One practice may have very talented personnel; the other has more name recognition, which can translate into greater marketing success. Or one practice may bring capital to the table that the other needs for expansion. Even though on paper a merger may seem like a good idea, owners and employees of the two practices may not mix well. One team may be used to autonomy; the other may thrive under micromanaging. Make sure that your proposed marriage with another practice won’t suffer from incompatibility.

Control

Trap: Failing to clearly establish who gets what.

Rarely is a merger a 50-50 proposition. Carefully allocate each owner’s percentage before committing to the merger. Give consideration to pre-merger accounts receivables as well as any promised/expected bonuses that have not yet been paid before a merger is completed.

Trap: The inability of one owner to cede the last word.

One of the key issues for physician practice owners when two practices merge is who will call the shots. Until the merger, each owner has been supreme within his or her practice. Decide who will be in charge when the merger is completed. Make sure each owner knows which one has the final say. There are ways to have these decisions rotate for fairness and also ways to deal with tiebreakers. These are critical components of your governance documents.

Other issues to settle before the merger include:

Practice name: Will one name survive? Will you create a new name?

Positions on the governance board: Decide in advance how many representatives each former practice will have on the new board.

Staff retention: When practices merge, there is duplication of functions and you need to avoid redundancies. Negotiate before closing the merger who will stay and who will have to leave.

The unknown

Trap: Failing to bring in professionals at the outset.

Physician practice owners may shake hands on a deal before even talking with a consultant or their accountants and attorneys about the merger. This mistake can be critical. A seasoned consultant can help owners think through the structure of the deal as well as (and perhaps more importantly) the shape of the practice after the merger.

Trap: Incurring unanticipated liabilities.

What you don’t know can hurt you in a merger. When deciding whether to merge with another practice, be sure to do your due diligence and check for any debts, judgments or potential judgments, payroll and other taxes, contracts with suppliers, employment contracts with staff, and other obligations you may incur. Again, here is where an experienced consultant is well worth the cost. Due diligence can be very time consuming.

If your practice has one type of retirement plan and the other has a different type of retirement plan, decide which plan will be used by the new company. This and other benefits will be uncovered and evaluated during due diligence by your consultant, and as previously mentioned there will need to be a plan put in place before the merger is consummated as to what these benefits will look like post-merger

Final word

You don’t necessarily have to merge in order to grow your practice. You can gain many of the advantages that a merger offers while retaining your autonomy simply by deciding to work closely with another entity. You may be able to accomplish your goals via a joint venture with a hospital, for example. Of course, any arrangement outside of a merger can have some legal healthcare implications, so you should certainly talk with a healthcare attorney before proceeding down one of these avenues.

M&A is a powerful strategy that practices have been using for decades. As long as it is done correctly and with enough preparation, you’ll be able enjoy its benefits, in the long run, should you choose to do it. Use your outside professionals early on and the road to future success will be laid out much more clearly.

Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)

__________________________________________________

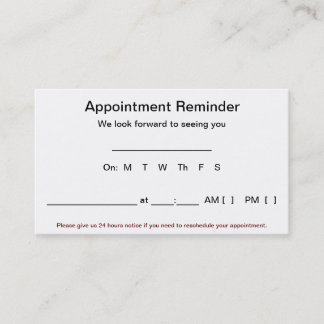

Appointment Reminder Cards

$44.05

15% Off

$56.30

15% Off

$44.05

15% Off

$44.05

15% Off

$56.30

15% Off

No comments:

Post a Comment