Stay abreast of the trends and significant changes: In no small measure, the medical billing rules and regulations are subject to changes. Thus, it is crucial for your in-house team to stay up to date with the significant changes to avoid claim denials.

Right KPIs for the long win: Consider these account performance metrics when it comes to the streamlining of accounts receivables process:Collection

- Effective Index: Ensure that the CEI is close to the mark of 100, which acts as an indicator that you are successfully collecting payments from all of your clients.

- Average Days Delinquent: The ADD refers to the average of the days since the client’s payment is pending. You have to try to keep this score as minimum as possible for a smooth collection process.

- Days Sales Outstanding: This refers to the time recorded to collect the payments. The ideal DSO should be less than 30 days so ensure to keep the scale managed by your in-house team.

Revised invoices: To tackle the challenges of revised invoices, look up to the billing policies and meet your staffing needs, kicking out the errors for delayed payments.

Mark procedures upfront: Once you document and mark the procedures of managing the AR, it ensures immense clarity and consistency. Ensure that your procedure has mentioned all of the following: invoicing dates, necessary data inclusions, recordkeeping procedures, follow-up procedures, and collection methods for the pending payments.

Align credit and collection policies: To avoid situations of extending credits to your clients, it is important to align credit policies way ahead of time. This will ensure a streamlined process and address the issues of overdue accounts in the most systematic manner.

Insurance eligibility verification: As per the eClaim Status, insurance eligibility verification causes more than 75% of claim rejections and denials by payers. To ensure financial growth of your medical setting, it is crucial to check the patient’s eligibility and coverage. There are different ways to find out the eligibility: using third-party products to scrape data and using software on the payer’s site. It is significant to check the coverage date, identify whether it is a Co-pay amount or Deductible amount.

Identify the reasons for denial: As per Equifax, poor billing practices cause doctors in the US to lose an estimated $125 billion each year. To ensure that the billing collections are improved it is significant to identify the reasons which result in claim denials. A few of the reasons for claim denial are mentioned below:

- Data error in registration

- Lack of necessary information

- Duplication of claims

- Incorrect patient information in the records

- Credentialing errors

- Documentation errors

Accurate information on debtor listicle: Every medical setting has their own workflow and methods of organization thus, following any advice on a blindnote is not sound advice. It is important to access information of debtors at your medical setting. Know your organization's debtors, claim build-up and analyze critical internal processes. This ensures a streamlined process of how to approach your debtors and ensure a managed yet quick cash flow.

Investing in automation tools: A multidimensional support takes a medical setting a long way. Right from analyzing big amounts to gathering necessary timeline of claims, automation has got you covered. Digital transformations and proper infrastructures like these ensure that the AR management is highly- efficient.

Involve everyone for a smooth process: Medical institutions try to limit the AR management to the billing team however, when you involve all the other teams too, it ensures coordination. Loop in the sales team and managementteam too, avoiding redundancies and reducing piling of unnecessary costs.

The pertinent question is, whether you should outsource AR management for your medical setting

Having an in-house team to streamline the process and run software is always an option however, it comes with a lot of responsibility and stress. Thus, the best alternative is to outsource AR management. As per the BlueEHR, the Insurer AR must be maintained at 5% to 7% to mark good business performance. Who doesn’t want maximized cash flow and minimized costs, topped with healthy customer relationships? Take the right step and pick the right medical billing and coding company to streamline your AR management strategies and skyrocket results.

15% Off Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)__________________________________________________

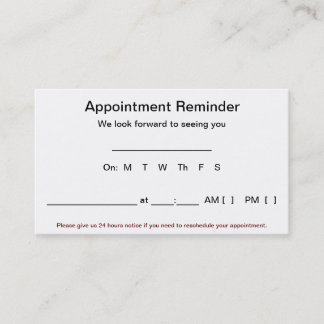

Appointment Reminder Cards

$44.05

15% Off

$56.30

15% Off

$44.05

15% Off

$44.05

15% Off

$56.30

15% Off

No comments:

Post a Comment