Medical practices may need to upgrade their equipment for many reasons and at any time. Whether you are just starting out and are equipping your practice for the first time, have been in business for a while and need to upgrade your equipment to the latest tech, or are dealing with an unexpected breakdown and urgently need a replacement, you may need to secure third-party funding to help you finance the purchase of new equipment.

Small Business Administration (SBA) loans are a popular option for medical practices looking to purchase new equipment, but these loans have a long application process and extensive paperwork requirements. Traditional lenders like banks also offer medical equipment financing in which the equipment will serve as collateral to secure the loan, with similarly strict approval requirements. If your practice doesn’t meet the requirements of the SBA or a bank or you need funding quickly, alternative lenders may be a better option.

Let’s take a closer look at how alternative funding can help medical practices upgrade their equipment.

Why You Might Need a Medical Equipment Loan

Medical equipment is necessary for practicing medicine, properly diagnosing patients, and running a business, but it is also costly to buy and repair.

Without a medical equipment loan, both new and established practices can find these items prohibitively expensive to purchase or repair. Not many businesses have tens of thousands of dollars readily available to buy equipment when it’s needed, so getting a traditional loan, medical equipment financing, or alternative funding is often required to fully fund equipment purchases.

Types of Equipment that Medical Equipment Financing Can Be Used to Purchase

Loans can be used to purchase all different types of medical equipment, including:

- Standard equipment like exam tables and computer software

- Imaging equipment such as x-ray and ultrasound machines

- Lab equipment

- Other specialized equipment depending on your area of focus

- Why Should You Consider Alternative Funding for Purchasing Medical Equipment?

Alternative funding is typically easier to acquire than funding from lenders like the SBA or banks. Rates and fees may be higher than these lenders, but approval requirements are more lenient and are based on the overall health of your practice rather than your credit history and financial documentation. Alternative lenders are also more likely to grant loans to newer businesses, while the SBA and banks typically require a business to be in operation for a minimum of two years.

With a streamlined online application, alternative lenders can also approve your application much faster than the SBA or a bank. Approval can be granted in as little as 24 hours, making alternative funding an ideal option for medical practices that need money quickly to cover unexpected equipment repairs or take advantage of short-lived opportunities to buy new equipment at a reduced price.

Multiple types of short- and long-term funding are available from alternative lenders depending on your medical practice’s needs, including:

- Merchant Cash Advances: In exchange for a percentage of your daily or weekly debit and credit card sales, you are “advanced” a lump sum of cash. Merchant cash advances are ideal for medical practices that process a lot of debit or credit card transactions.

- Lines of Credit: This functions similarly to business credit cards, but with higher limits and longer terms. Lines of credit offer the most flexibility by providing your practice with an ongoing source of working capital that can be drawn from and repaid as needed. You only ever pay interest on the amount you borrow and, once you are approved, it is available at any time—as long as you are paying it off.

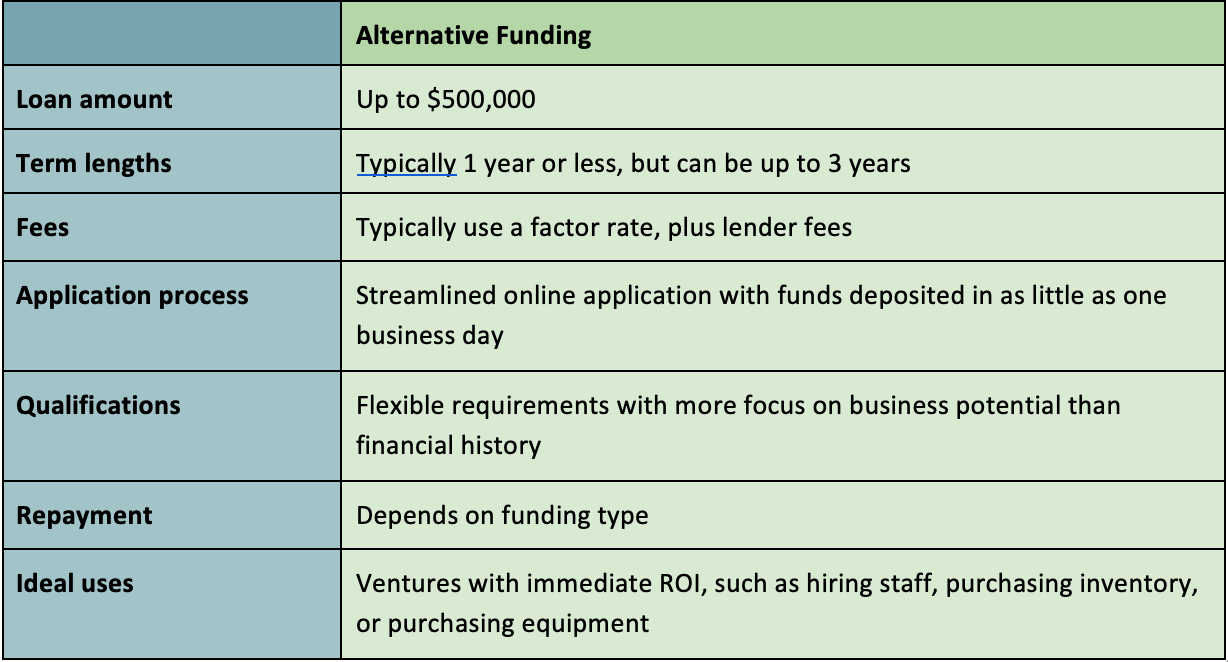

Here is a quick breakdown of what alternative lenders have to offer:

Why is Alternative Funding Ideal for Purchasing Medical Equipment?

Alternative funding is ideal for purchasing medical equipment because it has a faster application turnaround, meaning you don’t have to plan ahead or wait months to make your purchase and improve your practice.

Flexible approval requirements also mean that funding may be easier to acquire from an alternative lender, especially if you’re a newer business, have a low credit score, or don’t meet the strict criteria of the SBA or a bank. It also typically has no collateral requirements, so you don’t have to worry about losing assets in the event that you can’t make your payments.

15% Off Medical Practice Supplies

VIEW ALL

Manual Prescription Pad (Large - Yellow)

Manual Prescription Pad (Large - Yellow) Manual Prescription Pad (Large - Pink)

Manual Prescription Pad (Large - Pink) Manual Prescription Pads (Bright Orange)

Manual Prescription Pads (Bright Orange) Manual Prescription Pads (Light Pink)

Manual Prescription Pads (Light Pink) Manual Prescription Pads (Light Yellow)

Manual Prescription Pads (Light Yellow) Manual Prescription Pad (Large - Blue)

Manual Prescription Pad (Large - Blue)

No comments:

Post a Comment